Transaction Disputes

Disputing a Transaction

We hate when it happens, but the simple fact is, sometimes you need to dispute a transaction on your account, whether it’s due to a merchant error or suspicious activity. Fortunately, with Online Banking, you can initiate a dispute with a few simple clicks.Note: If your card has been lost or stolen or you believe a transaction is due to fraud, call 866.309.4934 (International: 303.967.1096) immediately to have your card blocked and order a new card. Do this in addition to disputing any suspicious transactions via Online Banking.

How to Dispute a Transaction

If you believe a transaction was made in error or for the wrong amount, or if you don’t recognize a transaction, follow the steps below to begin a dispute claim. Note that if you want to dispute multiple transactions, you will need to repeat this process for each one.

- Login to your Online Banking profile and select the account that contains the transaction you want to dispute.

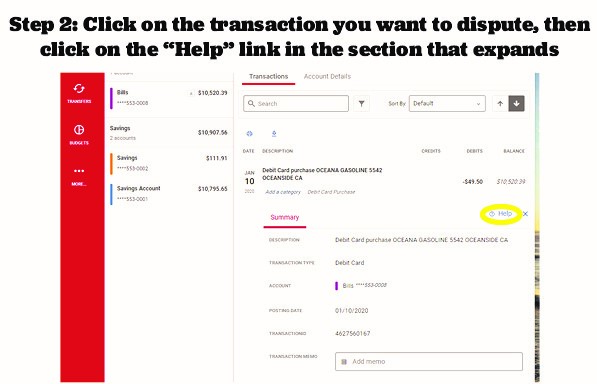

- Click on the transaction you want to dispute, then click the “Help” link in the section that expands.

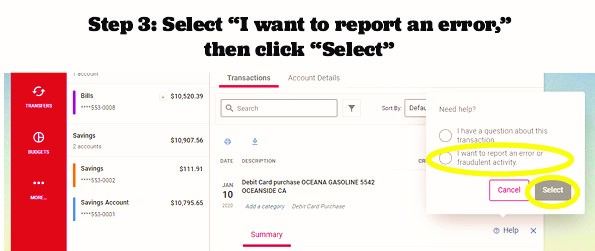

- In the pop-up window that appears, select “I want to report an error or fraudulent activity” and then click “Select.

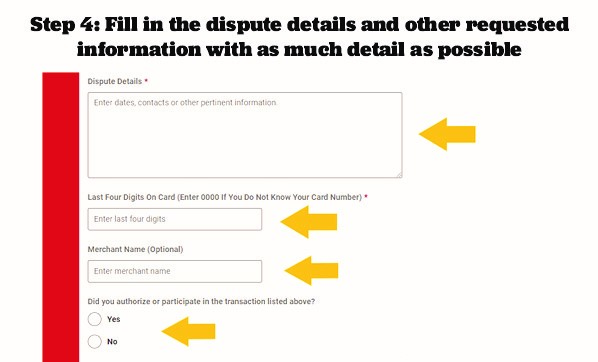

- Read the instructions in the new window that opens, then fill in the “Dispute Details” section of the form at the bottom of the page. Include as much detail as you can about the error or problem you’re reporting. Also fill in the last 4 digits of your card # (or 0000 if unknown) and the merchant name (optional), then select whether or not you authorized the transaction.

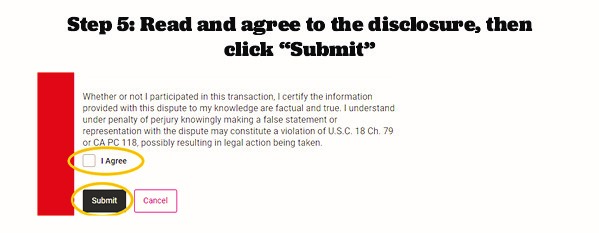

- Read and agree to the disclosure at the bottom of the form, then click “Submit.” Once the form is successfully submitted to us, you’ll be routed to a confirmation page that contains a link to the Message Center, where you can review the details of the dispute. Any follow up communications regarding the dispute will also appear here.

Remember: If you want to dispute multiple transactions, you will need to repeat the above process for each individual transaction.

Frequently Asked Questions

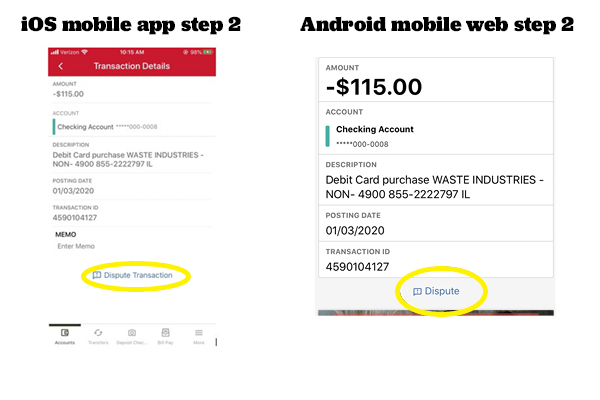

You can if you’re using the iOS version of the app. The process is almost the same — maybe even a little simpler. In step 2 above, instead of seeing a “Help” link when you tap on a transaction, you’ll see the option to “Dispute Transaction.” Tap this link and you’ll be brought directly to the dispute form referenced in step 4. So go ahead and skip right by step 3!

If you have an Android device, you’ll need to login to the mobile version of Online Banking through our website. Open a browser like Chrome or Firefox and navigate to www.frontwavecu.com. Click on the padlock on the top of the page to login using your username/member # and password (note that biometric login will not work). Once you’re logged in, make sure you’re in the “mobile” view (check the options at the bottom of your screen). Then navigate to the transaction you want to dispute, click on it and click the “Dispute” link at the bottom. Then follow the instructions starting with step 4 above.

Once we receive your claim we will respond to you via the secure Message Center within online banking. In general, we will tell you the results of our investigation within 10 days after we hear from you and will correct any error promptly. If we need more time however, we may take up to 45 days to investigate your complaint or question. If we decide to do this, we will “provisionally” credit your account within 10 days for the amount you think is in error (less any amount for which you may be liable), so that you will have the use of the money during the time it takes us to complete our investigation.

If we decide that there was no error, we will send you a written explanation within 3 business days after we finish our investigation. We will also make arrangements for the repayment of the provisional credit. You may ask for copies of the documents that we received in our investigation.