Person-to-Person (P2P) Payments

Person-to-Person (P2P) Payments are a digital alternative to cash and make sending and receiving money as easy as emailing and texting. Whether it’s repaying family and friends, paying allowance, splitting the check, or sending a birthday gift, P2P has you covered.

P2P Fraud Alert: The real Frontwave Fraud Team will never ask you for personal financial information or send you a text or email with a code you need to verify. For more information about common phishing scams, check out our infographic: "5 Ways Scammers Try to Steal Your Information."

How to Send a P2P Payment

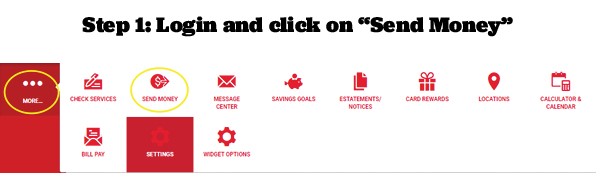

- Login to your Online Banking account, and click on “Send Money.” If you don’t see the “Send Money” button on your dashboard, click on “More….” This will bring up another menu, where you will find the “Send Money” button.

- On the next screen, click the button that reads “Launch Acculynk P2P Payment.” If you have never used this feature before, you will then be prompted to agree to a disclosure.

- Once you click "agree," you’ll be asked to verify your identity using Multifactor Authentication (MFA) before setting up the first transfer. After completing this step, you will be redirected to the “Send Money” page.

- Once on the “Send Money” page, fill out the details requested. Begin by entering either the email address or mobile phone number for the person you wish to send money to in the “About Your Recipient” section. You’ll need to enter this twice for confirmation. Next, in the “About Your Payment” field, enter the amount your wish to transfer. You can also add an optional memo, for example, noting what the payment is for. In the final “About Your Account” section, enter your Frontwave debit card number and expiration date (both month and year).

- When finished entering your payment details, check the box at the bottom of the page to indicate you agree to the terms of service, then click “Send.”

That’s it – payment sent! The recipient will receive a notification at the email address or mobile phone number you provided with instructions on how to obtain their funds.

NOTE: For your security, you'll be asked to verify your identity before completing your first P2P transaction each time you log in to Online or Mobile Banking. All P2P transactions within the same session will not require additional verification.

How to Cancel a P2P Payment

- Login to your Online Banking account and click on “Send Money.” If you don’t see the “Send Money” button on your dashboard, click on “More….” This will bring up another menu, where you will find the “Send Money” button.

- On the next screen, click the button that reads “Launch Acculynk P2P Payment.”

- On the “Send Money” page, click on the “Menu” button that appears at the top, then select “Transaction History.”

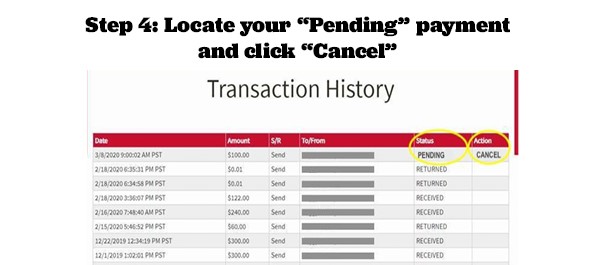

- In your “Transaction History,” locate the “Pending” payment you wish to cancel, then click “Cancel” under the “Actions” heading. Note this option will only be available to you if the payment hasn’t been claimed by the recipient yet. If the payment has already been claimed (Status: “Received”), it cannot be canceled.

How to Add Contacts

If you plan to use P2P payments to regularly send certain people money, you may want to add them to your contacts list. This will make it easier to quickly send your payments, without having to enter their email address or mobile phone number each time. To add a contact:

- Login to your Online Banking account and click on “Send Money.” If you don’t see the “Send Money” button on your dashboard, click on “More….” This will bring up another menu, where you will find the “Send Money” button.

- On the next screen, click the button that reads “Launch Acculynk P2P Payment.”

- On the “Send Money” page, click on the “Menu” button that appears at the top, then select “Manage Contacts.”

- On the “Manage Contacts” screen, click on “Add New Recipient Contact.”

- On the next screen that pops up, fill in the person’s name, email address and/or mobile phone number, then click “Add Contact” to save their information.

Frequently Asked Questions

Note, however, that the “Menu” button isn’t accessible from the “Send Money” page in the app, so if you would like to cancel a payment or update any information, you will need to login through Online Banking on our website.

Just remember - even though the connection is secure, you should never share your private Online/Mobile Banking login, password or security codes with anyone. Frontwave will NEVER call you to ask for this information! For more information about common phishing scams, visit this page >