Alerts (Notifications)

Alerts are automated messages that help you stay informed about your account in real time. Some alerts, like security alerts, are required and already set up for you. Other alerts, like automatic deposit and low balance alerts, are optional and won’t be sent unless you turn them on. The “Alerts” widget in Digital Banking lets you adjust how you receive alerts and set up optional alerts, if desired.

How to Change the Way You Receive an Alert

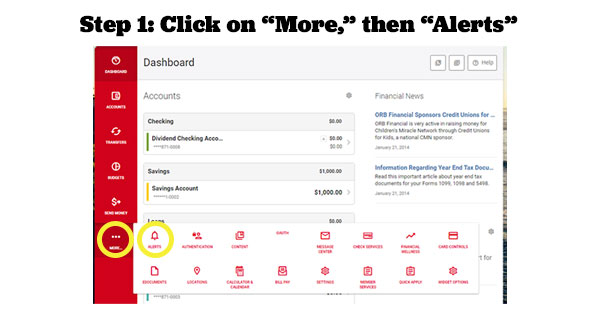

- Login to your Online Banking profile, and click on “ALERTS.”

- Any alerts that are already enabled on your account, such as the required General Alerts, will have a toggle button that is turned "on." For General Alerts, you cannot turn off the toggle button, but you can change how these messages are sent.

- Once you have selected the alert category, select the specific alert that you would like to modify and the click the toggle buttons next to contact methods you wish to turn on or off. Then click “Save.” (Note that for required General Alerts you must select at least 1 form of contact.)

That’s it! You’ve changed the way you’ll receive messages for the selected notification. Keep in mind, you’ll have to repeat this process for each notification type you wish to update. And if you’ve never enabled SMS/text message notifications before, you’ll need to follow the instructions below.

How to Enable SMS (Text Message) Notifications

Before notifications can be sent to you via SMS/text message, you must first add and verify your mobile number.

- Login to your Online Banking profile, and click on “MORE…” then “SETTINGS.”

- From the main “Settings” page, click on the “Contact” tab. Then click on the pencil icon next to the entry for “Mobile Number.”

- In the drop-down that expands, enter the mobile number you want to receive SMS notifications to, then click “Save Changes.”

- You’ll receive a “Success” message and be returned to the main “Contact” tab, where you’ll once again need to click on the pencil icon next to the entry for “Mobile Number.”

- In the drop-down that expands, click the box next to the statement “I would like to receive SMS text messages to this number.” Then click the “Send a code via text” button that appears on the screen. This will send a confirmation code to the mobile number you just added to your account.

- When you receive the confirmation code via text, enter it into the boxes now visible on the “Contact” tab (you will need to enter it twice). Then click “Save Changes.” You’ve now enabled SMS/text messaging for your account.

To add SMS/text messages to a particular notification, follow the “How to Change the Way You Receive a Notification” instructions above.

How to Set Up a New Alert

You have the option to enable alerts for deposits, withdrawals, debit card purchases, transfers, account balances and more. The full list is available within Online Banking. Let’s take a look at how to set up these optional notifications.

- Login to your Online Banking profile, and click on “MORE…” then “ALERTS” in the main widget menu. Here you can view the full list of available alerts. Any alerts that are already enabled on your account, such as the required General Alerts, will have an icon next to them showing how the automated messages will be sent. In the example here, we can see that email notifications are on for General Alerts.

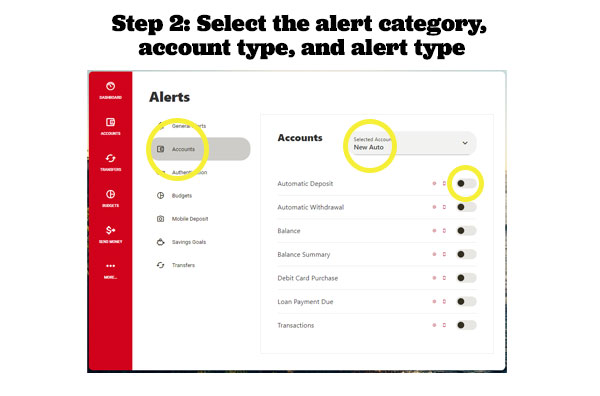

- To enable an alert, click on the alert type on the left side of the window, choose the account you are updating from the drop-down menu., and then click on the toggle button for the alert you would like to enable.

- Once clicked, select from three alert options – Email, Push and Text. Please note that you will need to agree to receiving text messages via the Settings Widget before “Text” is made available as an option.

- You will now see that the alert is turned on. To turn off the alert, click the toggle button on the far right. Please note that all previous settings will be lost when a notification is turned off. If you decide to turn the alert back on, you will need to start from the beginning to reselect your alert methods.

- For certain alerts, you will need to enter additional information. For example:

- For Balance Alerts, you will need to enter a low and/or high amount at which the notification will be triggered. (If you leave both of these amounts blank for an account, you will not receive Balance Alerts for that account.)

- For Balance Summary Alerts, you’ll need to select whether to receive a notification daily or weekly and the day/time you want to receive it, as well as selecting the account(s).

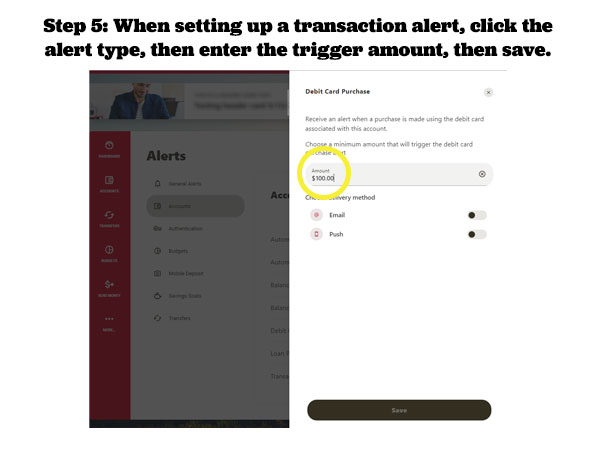

- For Debit Card Purchase Alerts, you’ll need to enter a minimum amount at which a notification is triggered.

- For Transaction Alerts, you’ll need to click “Add Rule,” then select when you want an alert triggered from the drop-down list, then enter the triggering amount. Remember to click “Save” at the end to save your changes.

- Once you save your selections, you’ll return to the alert settings screen, where you’ll see a list of options of where to receive these alerts. Select the contact methods* you want the alerts sent to. Then click “Save.”

That’s it! Your alert has been set up. Repeat this process for any additional notifications you wish to enable.

*NOTE: If this is your first time choosing to have SMS/text message alerts sent, see instructions above.

Frequently Asked Questions

- Remote Deposit Completed (when a Mobile Deposit goes through)

- Automatic Deposit Alert (when an automatic deposit, like a direct deposit, is made)

- Automatic Withdrawal Alert (when an automatic withdrawal, like a recurring bill payment, is made)

- Balance Alert (when a balance goes above or below an amount you specify)

- Balance Summary Alert (to receive a daily or weekly summary of your account balance(s))

- Debit Card Purchase Alert (when a purchase is made above an amount you specify)

- Insufficient Funds Alert (when the balance of an account goes below $0)

- Transaction Alert (when a credit or debit transaction hits or goes over an amount you specify)

- External Transfer Account Blocked Alert (when an external account you’ve added is blocked by an administrator)

- External Transfer Canceled Alert (when an external transfer you set up is canceled)

- External Transfer Submitted (when you set up an external transfer)

- Transfer Fails (when a transfer you set up fails to go through)

- Transfer Succeeds (when a transfer you set up goes through successfully)

- Budget Category Exceeded Alert (when the budget you set for a certain category of expenses is exceeded)

- Budget Exceeded Alert (when your overall expenses exceed the budget you set)

- Budget Summary Alert (a current summary of the budgets you have set up for your account(s))

- Savings Goal Completed Alert (when you reach the targeted balance you specified for an account)

- Savings Goal Endangered Alert (when you are nearing the end of a savings goal deadline you set but are not close to having enough money in your account)

- Online Banking Access Alert (when your username is used to login to Online Banking)

- Secure Message Alert (when you receive a new message through the secure Online Banking platform).